The price dynamics of the coffee market simply explained

The green coffee market is subject to dynamic price fluctuations. Coffee is a commodity traded via futures (exchange-traded forward contracts). The result is a so-called "world market price for coffee" (C-Market Price), which serves as a reference price for green coffee trading.

Our goal is to source all green coffee directly from the producer. This allows for long-term, sustainable partnerships between coffee farmers and roasters. On the one hand, a larger portion of the added value remains in the country of origin, and coffee farmers become less dependent on price fluctuations on the global market.

Rodolfo Ruffatti Battle on his Finca Esquipulas

However, direct purchasing is only possible for larger quantities, which is why we currently source coffee from traders who guarantee a transparent supply chain all the way to the farm or cooperative. As coffee roasters, we therefore balance the need for a diverse product range with maintaining the most direct relationship possible with our coffee producers.

The world market price of coffee is particularly influenced by the harvest yields of the largest coffee-producing countries, especially Brazil, Vietnam, Colombia, Indonesia, and Ethiopia, which together account for 75% of global production . Crop failures are particularly caused by devastating weather events (e.g., drought, frost), political unrest, even armed conflicts, or the spread of fungal diseases in some growing regions.

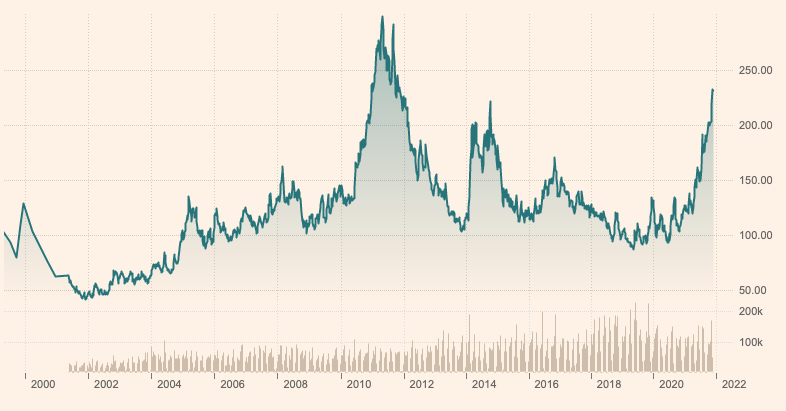

Since April 2021, about a year after the outbreak of the pandemic, the price of Arabica coffee has been rising rapidly—after many years. Since then, the price of a pound (equivalent to 0.45 kg) has doubled from USD 1.25 to almost USD 2.50 . There have been repeated sharp price fluctuations in the past, most recently in 2011 and 2015 .

The reasons for the current sharp rise in green coffee prices are manifold. Firstly, both drought and frost have led to massive crop failures in various regions of Brazil. This has reduced expected production in Brazil by 20% compared to the previous year. These massive crop failures in the world's largest coffee-growing country are primarily responsible for the decline in global production from 176,000 to 165,000 bags.

In addition, an increase in coffee rust (a fungal disease) in Honduras and the simmering civil war in Ethiopia are leading to further crop failures in two major coffee-growing countries. This market situation of lower production, coupled with higher coffee consumption due to the economic recovery, is a major factor in the sharp price increase. But it's not the only one.

Global trade has been thrown out of its meticulously timed balance by the lockdowns during the pandemic, the blockage in the Suez Canal, and an acute shortage of empty containers . This has slowed the processing of container ships at ports of call and departure worldwide, leading to a backlog . The simultaneous high consumer demand is causing transport costs for the few available containers to rise dramatically .

Photo: Ian Taylor

Reports of panic-buying used, empty shipping containers are reaching us from several coffee-growing countries. These dynamics have caused transport costs for shipping the green coffee and its overland delivery to rise dramatically.

Furthermore, inflation is rising . Due to the ultra-loose monetary policies of central banks around the world, prices for goods needed for coffee cultivation and post-harvest processing are also rising. These include machinery and, in particular, fertilizers . The wage increases urgently needed in the coffee-growing countries due to inflation are also increasing production costs, as are higher energy costs, which will also impact the price of coffee in the medium term.

As a small coffee roaster with high standards of freshness and quality, we purchase our green coffee seasonally, according to the harvest cycles in the growing countries. Stockpiling green coffee for years when market conditions are favorable is far from our practice. We fundamentally welcome stable, fair prices for coffee farmers and do our part to the best of our ability. Due to the complex inflationary trends beyond green coffee prices, the higher costs will likely also reach end consumers.

Leave a comment